Client Alert – Workers Compensation Audits

We have seen an increased number of audits being conducted on clients’ Workers Compensation Policies and are seeing a number of recurring issues arising.

This alert highlights some of the major issues we have seen from these audits. It is not intended to be a comprehensive checklist. For a more detailed listing of what is caught, visit: Wages Definition Manual

A number of years ago, it was necessary for clients to have an accountant’s report attached to the Workers Compensation Declaration; some comfort could be gained knowing the accountant had reviewed the declaration. However, since ceasing this requirement, clients have been completing the forms for themselves and getting into trouble. We do not believe this is intentional – the rules are so complex, it is difficult for a lay person to know what is to be included.

As a general note, you need to be aware that you may not ordinarily expect to include amounts included for workers compensation purposes in other forms you may need to lodge. Reading the legislation can be complex and difficult and it is little wonder small business are getting themselves into difficulty.

Here are some common challenges we are seeing:

Superannuation Payments

Not including all superannuation payments to employees in the actual numbers. The forms say wages but if you read the form carefully it will clearly say superannuation is to be included. This is all superannuation not just the SGC amounts.

Trust Distributions

Trust distributions to working directors where the trustee of the trust is a company. There are specific complicated rules dealing with this. In essence, if you have a working director of a trustee company who is not paid a wage or salary, you should include a ‘deemed’ salary.

The market rate for work is the minimum wage rate applicable in respect of the work (or work that is comparable to the work):

(a) pursuant to an industrial instrument in force under a law of the State

(b) if (a) does not apply, pursuant to an industrial instrument in force under a law of the Commonwealth

(c) if neither paragraph (a) nor (b) applies, as provided by the WorkCover Guidelines or as determined and notified by the Authority in the particular case.

The legislation seems to suggest the award rates can be used, however speaking to an auditor recently, they expect you to use numbers based on the average wages from the Australian Bureau of Statistics. Latest numbers May 2016. Note however: if the actual trust distribution is less than this number, the lesser number is used. Bizarrely, if the trust has a loss no number is required.

Dividends

Where a dividend is paid in lieu of wages, the payment is counted as remuneration for the purposes of calculating workers compensation premiums.

The amount of payment to be included is based on the hours worked and the type of work performed. The amount is limited to the current market value of the remuneration that would be paid to a worker undertaking the same mix of duties and hours of work, and with the same skills, together with any allowances or other remuneration paid to the director for employee-related duties.

To determine the current market value of the remuneration, the employer may consider various sources, including: industrial awards, position vacant advertisements relevant to the general location of the director, salary surveys, or evidence supplied by recruitment firms or employment agencies. The amount may be more than in an industrial award, if activities undertaken exceed those duties that would be required of an employee under that award. For example, making decisions that relate to financial strategy/management decisions.

Certainly items 2 and 3 causes the greatest confusion and resentment amongst clients.

Contractors

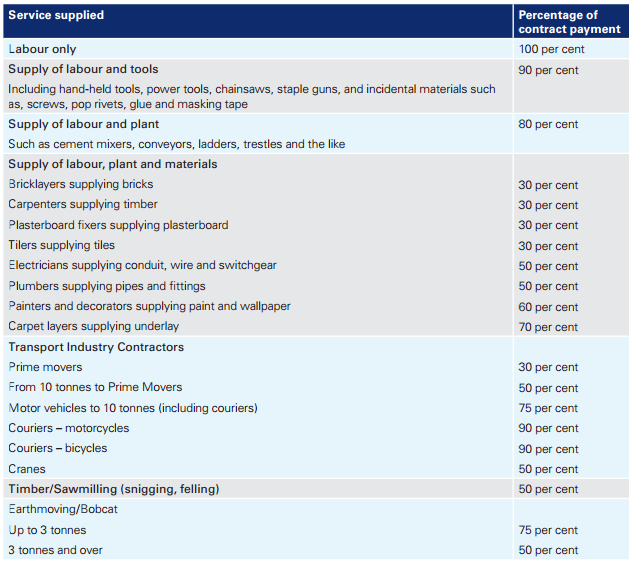

Again, reading the legislation is a highly complex area. This online calculator can assist in determining whether a contractor should be included in your workers compensation calculations. Here I would suggest talking with your accountant. To make matters even more difficult, you may only need to include a certain portion of the contractor charges in the calculation depending on what type of contractor they are:

Fringe Benefits

If you provide your employees with fringe benefits these are also included and commonly missed.

Record keeping and the audit process

Record keeping and the audit process

The audits look at three years’ worth of records. In nearly all cases the clients had not kept detailed workings on how they had arrived at their numbers requiring time being spent reconstructing records.

The records usually requested are:

- Wages books, calculations, PAYG Summaries and Business Activity Statement records

- Financial Accounts and Income Tax Returns to match the wages records to the accounts

- Fringe Benefits Tax Returns

- Copies of contractor invoices

The consequences of under-declaring include: paying the short fall insurance, possible penalties and interest and in some cases having to pay for the cost of the independent audit.

Clients of Allworths: if you have employees or use contractors, you may wish to consider taking out our Audit Insurance option which will cover our costs assisting you with a Workers Compensation Audit.

If you have any enquiries on the above, please feel free to contact us.