Is stock picking a mugs game?

“The only value of stock forecasters is to make fortune tellers look good” – Warren Buffet

By Mark Copsey, Director – Allworths Wealth Management

When we started in this game, we followed the typical path of the well-intentioned advisers. We subscribed to various research companies and based our stock picks on their recommendations after applying our own set of filters. In a rising market, as it was post-GFC, things were looking pretty good. In hindsight, even a monkey throwing darts at a list of stocks would have done pretty well! The eye-opener for me came a few years ago after reading an old book, A Random Walk Down Wall Street, by Burton Gordon Malkiel, first published in 1973. Essentially, the shocking news was most (if not nearly all) fund managers cannot beat the market on a regular basis. As Tony Robbins, in his book Unshakable, puts it: clients have been over-paying for underperformance. I will discuss overpriced fund managers in a later article.

A report published by S&P Dow Jones Indices on the performance of Australian Fund managers, verses the indices they measure themselves against, found that out of 786 Australian equity funds (large, mid and small cap, as well as A-REIT), 378 international equity funds, and 109 Australian bond funds, the majority of Australian funds in most categories underperformed their respective benchmarks, apart from the Australian A-REIT category.

Over the 10-year period ending 29 December 2017, more than 85% of international equity and Australian bond funds and more than 70% of Australian general equity and A-REIT funds underperformed their respective benchmarks on an absolute basis.

So, with this information in hand, a couple of us in the office tested it out with our own superannuation money and the turnaround using exchange-traded funds (ETFs) linked to various indices has been remarkable.

Using a balance of inexpensive Australian, international and bond ETFs (listed on the ASX and bought as any other share), it is possible to match or even slightly outperform the ASX.

The importance of rebalancing

The next strategy from the world’s leading investment experts is to rebalance your investments; so, if the equities part of the portfolio increases, you sell and move into say bonds or whichever asset class in the portfolio is out of balance. This is counter-intuitive to most of us. However, think about this: if you are invested in bonds and the share market collapses, the bonds should fall to a lesser extent than the equities meaning you can then sell the bonds and invest in equities while they are cheap. Again human emotion will make this difficult. However, imagine with a crystal ball buying US equities or an ETF such as IVV in 2008. You would now be sitting on a pretty substantial gain!

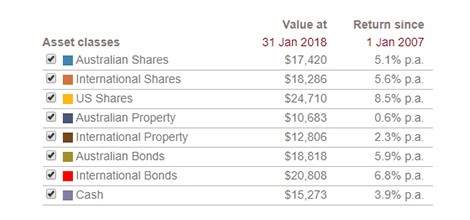

The table below shows the average return had you invested $10,000 in each of the main asset classes since 1 January 2007 (i.e. before the GFC):

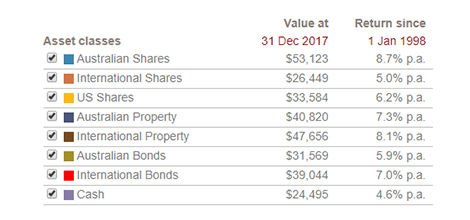

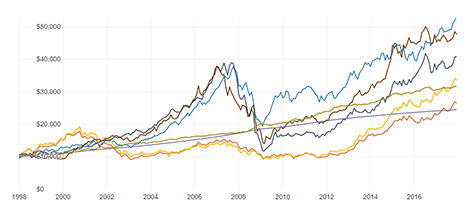

OK I hear you saying: “Well, with all that risk and volatility, why not stick it in cash and have an average return with no risk?” It’s not until you look at the big picture – and take the numbers out to say 20 years – that you see the compelling argument for investing in a balanced diversified portfolio. The chart below hopefully demonstrates why having a diversified portfolio and constant rebalancing are so important:

Source: Vanguard Volatility Index Chart (http://insights.vanguard.com.au/VolatilityIndexChart/ui/retail.html)

Here is where having a great advisor is important; one who can not only help you construct and monitor the portfolio, but also advise on structuring so you are invested in the most tax effective way possible.

However, if you don’t want to take my word for it, I’ll leave it to the world’s most famous investor. This is an excerpt from Warren Buffet’s letter to Berkshire Hathaway shareholders in 2014:

Most investors, of course, have not made the study of business prospects a priority in their lives. If wise, they will conclude that they do not know enough about specific businesses to predict their future earning power. I have good news for these non-professionals: The typical investor doesn’t need this skill. In aggregate, American business has done wonderfully over time and will continue to do so (though, most assuredly, in unpredictable fits and starts). In the 20th Century, the Dow Jones Industrials index advanced from 66 to 11,497, paying a rising stream of dividends to boot. The 21st Century will witness further gains, almost certain to be substantial. The goal of the non-professional should not be to pick winners – neither he nor his “helpers” can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.

Important Notice

The advice in this post is intended to be general in nature and does not take into account your personal circumstances. Before implementing any of the strategies discussed, we recommend you speak to your licenced financial advisor or solicitor. Allworths Wealth Management Pty Limited (AFSL 457 155) is the Wealth Management arm of Allworths Chartered Accountants. For further information, please contact us on (02) 9264 6733 or email growth@allworths.com.au.