Allworths’ Guide to Exchange-Traded Funds

Following our recent client event on Risk in Retirement, we received a number of enquiries in relation to Exchange-Traded Funds (ETFs) and how they operate. ETFs are not new and Allworths Wealth Management has been using them in client portfolios for close to 10 years. However, outside our wealth clients, they are a bit of a mystery.

This brief guide intends to demystify what we consider to be a great investment tool.

An ETF is essentially a type of managed fund. However in their pure sense they automatically track an index, which means they are not influenced by a sometimes misguided fund manager. An investor buys a unit in an ETF on a stock exchange in exactly the same way they buy any other share (e.g. CBA or BHP).

The funds in the ETF are then pooled to buy the underlying stocks on the exchange they are tracking.

If an investor wanted to invest in a broad basket of Australian shares, but didn’t want or know which to pick, they could instead buy an Australian Shares ETF and be exposed to the performance of a large range of Australian shares via a single ETF trade.

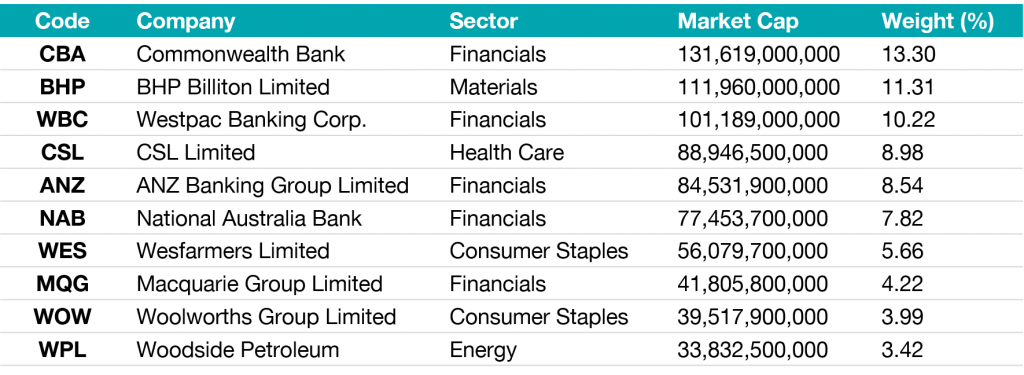

By way of example, the table below shows the top 20 companies listed in Australia by market capitalisation. An investor wishing to get exposure to these shares would need to purchase them individually and incur brokerage costs on each transaction.

Alternatively, they could purchase units in an index-tracking ETF, for example, the Vanguard Australian Shares Index ETF (VAS), which aims to track the performance of the 300 largest listed Australian companies (known as the ASX 300). The top 10 holdings of VAS consist of around 44 per cent of the ETFs net assets. Note that the top 10 holdings exactly match those in the table above.

– Morningstar, Investing Basics: A beginner’s guide to ETFs

The chart below shows the performance of three ASX ETF trackers compared to the ASX 300 (“XKO” on the chart). As you will see, the performance pretty much mirrors the index.

ETF Advantages

Diversification

ETFs are an amazing tool to effectively diversify an investment portfolio as you are able to directly invest in an overall market instead of individual stocks. In addition, there is a very wide range of ETFs in existence. This wide range includes many indices and asset classes, including overseas markets. The advantage of this broad range is that it allows investors to access markets that were generally hard to access for a small investor in the past.

Liquidity

ETFs can be bought and sold on trading exchanges just like a share without the restrictions associated with managed funds.

Low cost

ETFs have extremely low costs when compared to actively managed investment funds as they do not require an investment manager to be involved in picking stocks; the process is highly automated. ETF fees are generally less than 0.5 per cent in most cases.

Transparency

Investors are able to view the full portfolio holdings of their ETFs at any time via the ETF provider’s website.

ETF Potential Negatives

Outperformance

In contrast to managed funds, ETFs are not designed to outperform the market but rather to mirror it. However, it is important to note that over the long term there have been very few, if any, active managed funds that have managed to outperform the market.

Wide product variations

Whilst the wide variety of ETFs is often viewed as a positive, this also means that some of them may not be suitable for individual investors. ETFs use various methods to mimic their chosen index and some of these methods may create more investment risk.

Are ETFs Risky?

All investment products have an associated risk and ETFs are no different. Like regular shares, the underlying holdings are vulnerable to market movements. For example, if you invest in an ETF that provides exposure to the Australian share market, movements up or down in the share market will lead to positive or negative investment performance in the ETF.

However, the diversification benefit of ETFs means that these risks can be reduced. So, unlike owning shares in one company that could perform poorly, your risk is mitigated by the fact that you own a smaller piece of many investments that will not be adversely affected by a one-off poor performance by a particular stock.

How to invest in ETFs

Investing in ETFs is simple as they can be traded like any share. You can buy ETFs via your online brokerage, your stockbroker or your financial planner.

Allworths’ opinion on ETFs

Allworths Wealth Management has been using ETFs since the inception of the company; we think they are a great way to diversify clients’ (and our own) portfolios. However, before investing in any financial product, including ETFs, please speak to your investment advisor or give us a call to discuss whether they are appropriate for you in light of your current circumstances.

For more information, please call Mark Copsey on 02 9264 6733 or email us: growth@allworths.com.au

Further Information

If you would like to learn more about ETFs, watch the video below from our recent client event, Risk in Retirement. Tim Sparks from Vanguard (a world-leading ETF manager with AUD $6.8 trillion assets under management) takes us through a highly informative introduction to ETF investing (23:00):

Allworths does not guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice has been prepared by Allworths Wealth Management Pty Limited AFSL 457 155 without reference to your objectives, financial situation or needs. You should consider the advice in light of these matters and, if applicable, the relevant product disclosure statement before making any decision to invest.

DISCLOSURE: Employees may have an interest in the securities discussed in this report. Please request a copy of our Financial Services Guide (FSG) for more information.