Ballot Box Budget: Federal Budget 2019-20

On 2 April, Josh Frydenberg handed down the Federal Budget 2019-20. In summary: there were no big surprises. It was widely expected that a return to surplus would be announced, and also that forecast surplus revenue would be used in order to bring in personal income tax cuts prior to the federal election in May.

Subsequently, some have called it the: “Ballot Box Budget.”

The Budget headline was a 2019-20 surplus of $7.1b and forecast surpluses of $11b in 2020-21, $17.8b in 2021-22 and $9.2b in 2022-23; leading to the elimination of government debt by 2029-30.

Australia’s economy is forecast to grow by 2.75% in 2019-20 and 2020-21. Jobs growth and economic stability are tempered by severe weather events and an anticipated decline in residential construction activity and house prices. We summarise below what we regard as the main tax and superannuation-related points from the Budget impacting our clients:

Personal

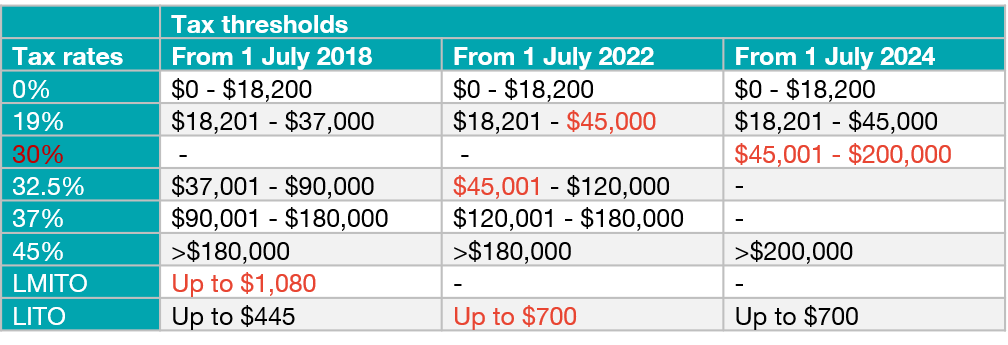

- Personal income tax offsets: small increases in the “low and middle income tax offset” (LMITO) for earnings up to $126,000 per annum and the “low income tax offset” (LITO) for earnings up to $66,667 per annum.

- Personal tax rate changes: the proposed changes to personal tax rates and thresholds are summarised below.

- Superannuation contributions: from 1 July 2020, Australians aged 65 and 66 will be able to make voluntary superannuation contributions (concessional and non-concessional) without meeting the work test. Currently, voluntary contributions can only be made if the individual has worked a minimum of 40 hours over a 30-day period (work test). Those aged 65 and 66 will also be able to make up to three years of non-concessional contributions under the bring-forward rule.

- Superannuation spouse contributions: the age limit for spouse contributions will be increased from 69 to 74 years. Currently, those aged 70 years and over cannot receive contributions made by another person on their behalf.

Business

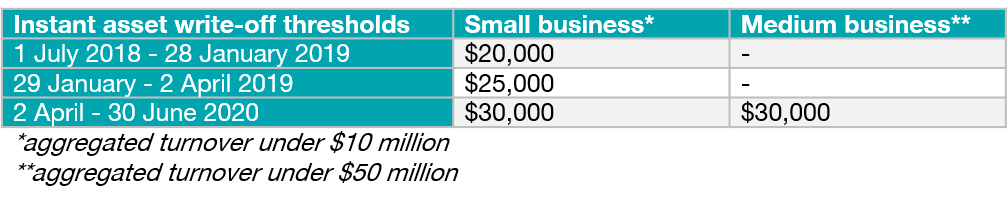

- Instant asset write-off: the amount of the instant asset write-off has been increased to $30k and expanded to businesses with an annual turnover of under $50m until 30 June 2020. This change takes effect from Budget night, as the enabling legislation has already been passed. The applicable rates and thresholds are now as follows:

- Assets will need to be used or installed ready for use from Budget night until by 30 June 2020 to qualify for the higher threshold. Anything previously purchased does not qualify for the higher rate but may qualify for the $20,000 or $25,000 threshold. Similarly, anything purchased but not installed ready for use by 30 June 2020 will not qualify.

- Division 7A changes postponed: proposed significant changes to the “Division 7A” rules regarding loans from private companies to shareholders and associates were potentially scheduled to commence from 1 July 2019. These changes have been deferred until 1 July 2020.

- ABN status stripped for non-compliance: From 1 July 2021, Australian Business Number (ABN) holders will be stripped of their ABNs if they fail to lodge their income tax return. In addition, from 1 July 2022, ABN holders will be required to annually confirm the accuracy of their details on the Australian Business Register.

ALP Federal Budget Reply

On Thursday April 4th, opposition leader Bill Shorten delivered his reply to the 2019-20 Federal Budget.

It’s important to consider the ALP’s Budget response, because – with the upcoming federal election – many of the government’s announcements may never be implemented. Shadow treasurer Chris Bowen told the ABC that, if Labor win the election, they will issue a new Federal Budget before next May, “in the third quarter of (this) year.”

- Income tax cuts: Labor will expand the LMITO to provide a larger offset for earnings up to $126k. Labor has refused to support a reduction in the 32.5% tax bracket to 30% from 1 July 2024.

- Depreciation deductions: Shorten reiterated the previous policy of providing a 20% depreciation deduction for capital assets costing more than $20k.

- Negative gearing: Shorten reiterated Labor’s previously announced plan to abolish negative gearing for people buying established investment properties.

- Other announced tax policies: no mention was made in the Budget reply speech of Labor’s other pre-election tax announcements, including:

- Abolishing refunds of franking credits for individuals (except pensioners) and superannuation funds.

- Halving the capital gains tax (CGT) discount from 50% to 25%.

- Increasing the top marginal tax rate from 45% to 47% (excluding the Medicare Levy).

If you have any further questions about the Budget, or just want to say hi, please feel free to contact us.