Tips for sound financial management in small business

In a previous blog post, we shared how important it is for small business owners to think like CFOs when managing their business and personal finances. Earlier this month, our partners Mark and David presented on this very topic at a well-attended seminar event in Sydney’s CBD. Below are some of the top takeaways from the event.

Role of the CFO

If you are or have been a small business owner, you’ll know that they wear many hats; sales, marketing, service, accounts payable, accounts receivable, HR; the list goes on… When it comes to accounting and finance, they often outsource to others such as their bookkeeper, tax agent and/or accountant. For many, that’s “the numbers side” taken care of. But these professionals generally only ensure your legal obligations are met, they do not perform the important role of a CFO to ensure the financial sustainability and long-term success of the business. That’s where you come in.

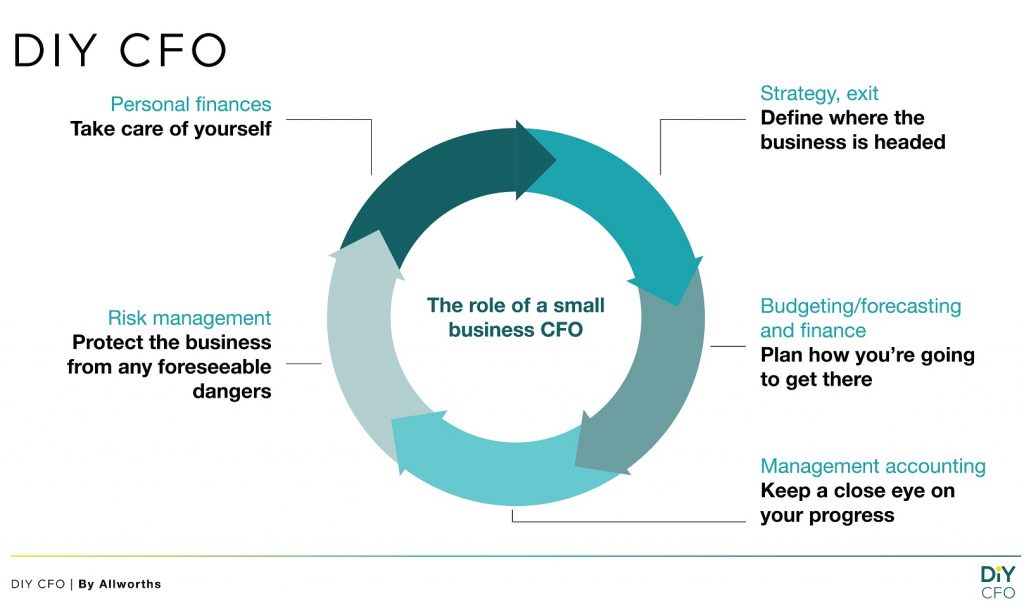

The way we see it, a small business CFO’s role broadly involves:

In the absence of a professional in-house CFO, the small business owner (i.e. you) must be the one taking on this role.

Defining where the business is headed

What do you want out of your business? Why did you get into it in the first place? Do you plan on getting out of it someday? How?

Depending on whether you want to continue working in the business, on the business (e.g. to become a passive investor, have multiple locations or franchise) or exit the business (e.g. via management buy-out, trade sale or IPO), you will need to take different actions in order to reach your goal.

It’s worth re-assessing your long-term plans regularly to see if you’re on the right track and if it’s time for a change.

Planning how you’re going to get there

Are you in the right business structure given your long-term plans? Often this can be hard to fix once you pick the wrong one at the beginning – but not always! When structuring your business, consider the goals of asset protection (e.g. your business’ main assets such as cash should not be sitting in the same structure as your operations in case of lawsuits and other liabilities), tax implications (minimising tax obligations) and attracting investors or buyers (potential buyers may have a preference for your business structure based on their tax and compliance needs).

Keeping a close eye on your progress

It’s crucial to set aside time in your calendar to go over your budgets and forecasts: your P&L, cash flow statement, and next 12 months of budgeting. This is typically not something your accountant, bookkeeper or tax agent does for you, so you will either need to request it or pull the relevant reports from online tools such as Xero. Or, do-it-yourself, with the help of templates and other available resources.

It’s incredibly important to be on top of your cash flow situation when deciding on business spending as there is a lag between sales made and cash received. You need to ensure the business has enough cash to pay for obligations such as tax, super and payroll. As the old adage says: “Revenue is vanity; profit is sanity; cash is reality.”

If you consistently find revenue is not covering costs, you need to consider if your business model actually works. Have you built into your pricing all the costs you will have, not just currently have?

Protecting the business from any foreseeable dangers

All businesses face many risks and a very common one is when a key person in the business dies, leaves or creates conflict with other partners or staff. Mitigating actions might include: taking out life insurance on business partners, setting well thought out shareholders agreements, documenting employee policies and procedures, and bringing in external consultants or instituting a board of directors.

One great way to help your small business become a bigger, more professional business is to think and act like one. Prepare regular board reporting packs that include monthly management reports, key metrics and performance improvement plans and have an accountability partner to whom you can report. This might include leaders from your business or external voices including: trusted mentors, an advisory board, a board of directors or even a spouse. These are the beginnings of good corporate governance.

Taking care of yourself

Finally, once you have the day-to-day financial operations dealt with, it’s essential to take time out of running the business to have a reality check. How is the business performing financially and is it capable of supporting you and your team? If not, will it be soon?

The business needs to fund the lifestyle you want, and this means you need to get the business to a place where you can remunerate yourself at a market salary, and have a personal wealth management plan in place. Your business shouldn’t be your only asset!

Full seminar

If you are interested in diving deeper into the above issues and learning more about CFO thinking, keep an eye out in our next newsletter for the full seminar video from Mark and David’s last “DIY CFO” seminar event.

And of course, you can contact us any time for a free no-obligation discussion to assist you further.