Demystifying bonds and bond funds

Australian investors have an obsession with Australian equities (shares), yet, at $2 trillion, they only represent around 2-3% of global equities. This is a fairly well-known fact and is slowly changing with the rise of exchange-traded funds “ETFs” bringing investors greater exposure to international equities. We wrote a handy guide to ETFs that you can access here.

However, if our non-wealth management clients’ portfolios are anything to go by, there is another asset class that dwarfs equities altogether yet barely gets any consideration.

The global bond market is estimated to exceed $100 trillion (compared to global equities at $64 trillion). In this article, we will try to demystify the bond market and provide some inexpensive and easy ways to access this giant industry.

Bonds are often referred to as defensive or low risk assets because they have historically usually delivered stable returns compared to equities and their prices have been less volatile. However they are not “risk-free” like cash and different types of bonds bring different types of risks.

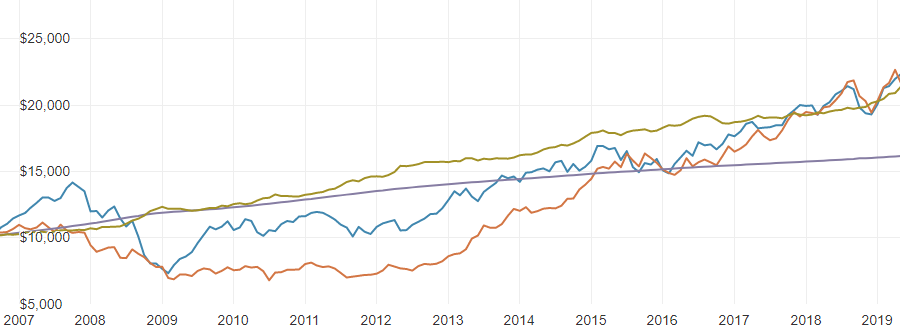

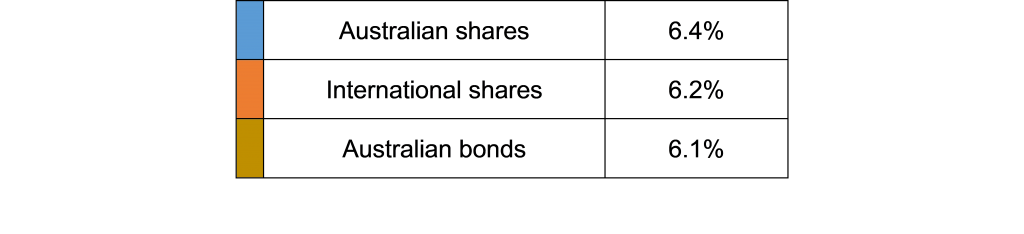

The below chart shows the average bond fund returns since 2007 compared to Australian and international equities:

Share prices vs bond prices – what’s going on at the moment?

Conventional portfolio theory says: when share prices go up, bond prices generally go down. However, for the year ended 30 June 2019, this was not the case with both equity and bond prices rising.

Ordinarily, when the economy is strong, share prices will rise and a strong economy will fuel inflation, which usually results in central governments putting the breaks on by increasing interest rates and forcing bond prices down. Recently we are not seeing this. The ASX/S&P Net Total Return rose 11.22% and the various Australian bond funds we use returned between 6% and 8%. Despite the share market rising, interest rates were on hold for a large part of the year and have now reduced to record lows.

What is a bond?

A bond in its basic sense is a loan you, the investor, makes to the issuer. In return for the loan, the entity promises to repay the loan on a fixed date and pay regular interest payments during the term of the loan.

Issuers can include federal governments both locally (Commonwealth Government of Australia) or internationally (e.g. United States Treasury, Republic of Italy), state governments or companies again both local and international.

The return on bonds

While it is easy to understand the concept of receiving regular interest payments on your loan investment, less understood is the fact that the bond price (or capital value) can go up AND down during the period it is issued.

It should also be noted the entity issuing the bond can default on its interest repayments and – worse still – the capital repayment at maturity. Think back to the 2001 Argentine government default (note: they also defaulted in 1827, 1890, 1915, 1930, 1982 and 2005-2016).

Fortunately, listed company defaults in Australia seem to have been pretty rare and I could only find three Australian companies defaulting in 2017. However, in the private company space, this seems to be a bit murky and is why we personally don’t go near private company bond issues. Remember: if the return seems too good to be true, it probably is!

Factors influencing bond prices

Interest rates

Bonds issued when interest rates are higher will pay higher coupons than bonds issued when interest rates are lower. Therefore, changes in rates impact the market value of the bond. This is because existing bond holders will consider the “opportunity cost” of their existing bond compared to new bonds issued at higher interest rates. When interest rates are rising, investors do not want to hold bonds with lower rates; they would prefer to hold a new bond at a higher rate. Conversely, when rates are falling, existing bonds with higher rates are more appealing.

This difference in the bond rate and the current interest rate is then equated into the price of the bond. So, generally speaking, when interest rates rise, the value of a bond can fall and vice versa.

Credit ratings

Like the equity market, bonds receive various ratings in terms of quality. AAA is said to be the safest and then, depending on the rating agency, down to BBB then junk. Unfortunately, the rating agencies leading up to the GFC either didn’t understand the rubbish that was held in some of the bond funds or (according to some) were bribed and assigned AAA ratings to what was actually worse than junk.

Needless to say, a bond assigned a lower rating due to its perceived risk is likely to fall in value.

Terms used when investing in bonds

It is easy to misunderstand the various terms used when assessing bonds and often people have some degree of confusion.

The coupon rate

This is the rate (of interest) a bond will pay annually. It is expressed as a percentage of the face value (i.e. the original price at which the bond was issued; NOT what you paid for the bond after issue), so a 6% coupon means investors receive $6 p.a. for each $100 of face value they hold of that bond.

The coupon rate remains constant throughout the life of the bond, because it is simply the rate set by the bond issuer when it was issued.

Current price

The amount investors pay for a particular bond today.

The yield to maturity (or total return)

When people talk about the yield of a bond, they are generally talking about the yield to maturity. This measures the “total return” investors should receive if they buy the bond today and hold it to maturity. It assumes:

- The investor can reinvest all coupons at the same yield; and

- The bond issuer remains viable and does not default.

It takes into account all of the coupon payments received from the date of purchase until the date of maturity. It also accounts for any capital gain, or loss, due to the $100 face value received at maturity. Whether investors make a capital gain or loss at maturity is dependent on whether the bond is acquired at a discount or premium to face value.

The current or running yield

Perhaps the most confusing of the terms is current or running yield, which is the bond coupon rate expressed as a percentage of the price. It does not, however, factor in the $100 face value received at maturity.

For example, a bond with a coupon of 6% pays $6 per $100 of bond p.a. until it matures in 2025. If that bond was trading at $110, its current yield would be 5.45% ($6/$110).

Investors would receive $6 p.a. for every bond they own so, from a yearly cash flow perspective, they receive a 5.45% return on the $110 they paid for the bond.

However, this measure does not factor in the maturity value of $100. By the time the bond matures in 2025, it will have lost $10 in price terms. This loss is amortised over the life of the investment.

Therefore, it is important to not confuse current yield with yield to maturity

Getting exposure to bonds

There are a few ways to get exposure to bonds:

- Brokers: there are a number of brokers who specialise in bonds and can assist you in buying individual bonds. Like stock picking, you need to choose the right one. At the time of writing, I found an Australian broker who could sell a fixed coupon bond in a US company maturing in October 2020 with a yield to maturity of 162.71% (no, that’s not a typo)! Needless to say I won’t be recommending it to my clients but it’s an example of what’s out there.

- Bond funds: these are managed funds that pool investors’ money and buy a wide variety of bonds thus spreading the risk. There are funds specialised in e.g. government bonds both local and international, corporate debt and emerging markets. Just watch out for the fees they charge. A lot of these can be purchased via the ASX using mFunds.

- ETFs: again, these are managed funds that buy a spread of different bonds thus diversifying the risk within a portfolio. They tend to follow an index so are less exposed to manager interference. These, like any other ETF, can be purchased via your broker account on the ASX.

We tend to favour the latter two due to the increased diversification they offer.

With the recent high share prices, and possibly further interest rate cuts on the horizon, it may be time to look at bonds as an asset class in your portfolio.

Contact us

If you wish to discuss bonds or any other matters in relation to your investments, please feel free to call us 02 9264 6733 or email: growth@allworths.com.au

Allworths Wealth Management is a financial advisory and investment management firm based in Sydney. It forms part of the Allworths group, which traces its origins back to 1897 rural NSW.

Disclaimer

The content of this post is general in nature. Any general advice has been prepared by Allworths Wealth Management Pty Limited AFSL 457 155 without reference to your objectives, financial situation or needs. You should consider the advice in light of these matters and, if applicable, the relevant product disclosure statement before making any decision to invest.