A cautionary tale: the facts on White Ribbon Australia

By Colleen Hosking, Director at Allworths Assurance & Advisory

It surprised and saddened many of us on 3 October 2019 to hear that the domestic violence charity, White Ribbon Australia, had gone into liquidation. The company appointed the insolvency firm Worrells, and their report is due out later this year.

However, if you review the accounts from the Australian Charities and Not-for-profits Commission website, it’s not hard to see some of the difficult trends the charity was facing in a time of rapid expansion and climbing costs.

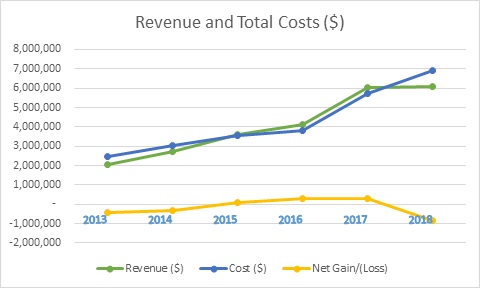

The graph below shows trends in revenues and total costs from 2013 to 2018, with the yellow line indicating the profit or loss for each of the relevant years.

This chart demonstrates fast-growing revenue, from $2M in 2013 to $6M in 2017 and 2018.

A time of rising costs and stagnating revenue growth

Interestingly, the graph also illustrates growing total costs for the same period. While revenue came in at $6M in 2018, costs exceeded revenue by $913K, with total costs in that year of $6.9M.The statement of cash flows also highlights payments to suppliers and employees increased from $4.9M in 2017 to $7M in 2018, an increase of 43%, resulting in a negative cash flow from operations.

Employee costs increased in the same period from $1.1M in 2013 to $4M in 2018. Key Management Personnel “KMP” compensation increased from $160K in 2013 and remained at around $200K in 2014 to 2016. The KMP remuneration then increased to $887K in 2017 and $1M in 2018. This was a tumultuous period of 2 CEO’s turnover, with an acting CEO in place at year-end, and a year of turnover at the Board Chair level.

The writing was on the wall

Going concern is addressed with a note to the accounts for the year ended 30 June 2018. It states that, notwithstanding the loss for the year of $841K and a net current liability position of $413K, the main liability for the company was unearned income of $1.8M of which $770K is not refundable.

The directors also implemented a cost savings program which should enable the company to reduce operating losses in future years. Net assets weren’t optimal as at 30 June 2018, at $262K (including intangible assets of $361K). It couldn’t afford to make another loss… the writing was on the wall.

What we as NFP leaders can learn

Directors must consider many factors when declaring that their company would be able to meet its debts, as and when they fall due, for at least a year from the date of signing the financial statements. In the case of White Ribbon, the accounts were signed on 31 October 2018 and the liquidation announcement was made on 3 October 2019.

If there is a cost savings program in place, as noted in the accounts, costs of redundancies may not have been considered. A fall in revenue in August 2019 also may not have been expected.

There are many organisations that face cash flow challenges in running their business. These include:

- Biotechnology companies moving from R&D phase to commercialisation

- Manufacturing companies with seasonal demand for their product and therefore seasonal cash flow

- Companies facing rapid growth and cost blowouts

- Not-for-profit companies without sustainable revenue streams

In these companies, it is essential to analyse and challenge budget expectations vs. actual results around income and expenditure.

At the time the budget is prepared, prior to the commencement of the new financial year, it is necessary to ensure budgeted revenue is not aggressive and contingent on certain events occurring.

A statement of cash flows from operations and a balance sheet should demonstrate there is sufficient cash in the business; positive net assets and net current assets as well as positive cash flows from operations.

The importance of active governance

Management should be undertaking disciplined monitoring of budget vs. actual on a monthly basis and reporting to the Board of Directors at least on a quarterly basis. When a company has had significant losses, the Directors may prefer to meet on a monthly or weekly basis.

In fact, the types of companies listed above typically run on daily cash flow monitoring by the Finance Director and team with equally stringent monitoring of actual income and costs against budget by finance and the board at monthly meetings. When there are red lights or risks of not meeting budget income and costs, actions are implemented by the board promptly.

Being proactive and seeing problems before they arise

It’s always easier to see something that went wrong with the benefit of hindsight, but all I can see now is a charity with the best of intentions out of business and 28 people out of a job (excluding other redundancies in FY18 and in January 2019).

It’s so important to implement effective controls and governance to ensure not-for-profits can continue doing their essential, impactful work bettering society for us all.

Conclusion, for now

On 23 October 2019, Worrells posted a press release regarding the intellectual property assets of White Ribbon. There is interest in the brand and, prior to issuing an invitation for offers to purchase the assets of White Ribbon Australia on 9 October 2019, Worrells explored the relationship between White Ribbon Australia and White Ribbon Canada. Inquires with IP Australia established that White Ribbon Australia is the sole registered owner of its Australian and several international trademarks.

There may be further brand issues to address but let’s hope for a happy ending.