JobKeeper Update

By Keri Liang, Senior Accountant

Since March 2020, when the JobKeeper Payment scheme was announced, the program has helped thousands of Australian businesses who were feeling the sting of the pandemic remunerate their employees and keep them on the books. So far, this has come at a cost of $70 billion to the government.

Initially, the scheme was intended to run for six months, ending 27 September 2020. However, with the pandemic still affecting Australian businesses and the second wave of cases in Victoria, the federal government has extended the program. Albeit with new eligibility criteria.

JobKeeper 2.0

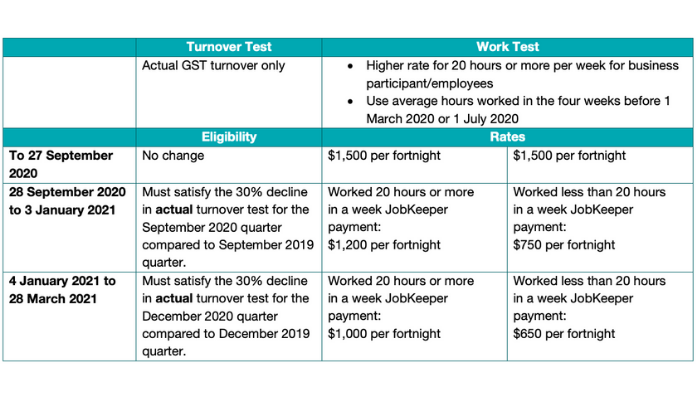

From Monday 28 September 2020, businesses will be required to reassess their eligibility for the JobKeeper extension. To do so, they must demonstrate that their actual turnovers have significantly declined in the September and December quarters compared to the same quarter in the previous year.

Note: this has changed slightly from the first announcement in relation to JobKeeper 2.0.

Additionally, the criteria for employee eligibility has been expanded. For an employee to be eligible for JobKeeper 2.0, they need to have been employed by the business from 1 July 2020 at the latest.

Summary of the ins and outs:

Additional points to note about employee eligibility:

- Employees must be currently employed by an eligible employer. This includes employees who were stood down or rehired.

- Employees must have been employed by their eligible employer (or another entity in their wholly-owned group) on either a full-time, part-time, fixed-term or long-term casual basis as at 1 July 2020. Note: a long-term casual employee is defined as one who has been employed on a regular and systematic basis for at least 12 months and is not a permanent employee of any other organisation.

- Employees must have been aged 18 years or older on 1 July 2020. Those who are 16 or 17 can qualify if they are an independent or not undertaking full time study.

- Employees must be either an Australian resident (within the definition of the Social Security Act 1991), or an Australian resident for the purpose of the Income Tax Assessment Act 1936 and the holder of a Subclass 444 (Special Category) visa as at 1 July 2020.

- Employees must not be receiving any of the following payments during the JobKeeper fortnight:

- government parental leave, or Dad and partner pay under the Paid Parental Leave Act 2010; or

- a payment in accordance with Australian worker compensation law for total incapacity for work

Feel free to reach out to us if you have any questions about JobKeeper 2.0.