Is there money in trading away pollution?

By Mark Copsey, Partner

As the business newspapers like to remind us every few days, the world is “decarbonising”. Some of the largest economies are introducing or expanding policies that will make companies pay for any greenhouse gas pollution they produce beyond a certain limit.

For those who know me I spend quite a few hours on the road each year visiting clients. Not being a fan of talk back radio, I use this time listening to investment podcasts. It was on a recent trip I discovered one of the most obscure asset classes I’d heard of (not crypto this time) and of course had to do the research when I was back in the office and jump straight in to making an investment.

Now you’ve of course heard of commodities like gold, oil, coal and gas; but, with carbon credits, we may be at the beginning of a bull market that could dwarf all of the above.

While the Australian Government has so far resisted putting a price on carbon, the EU’s Carbon Border Tax and similar schemes in the US, Japan and Canada could mean that multinational companies will soon have little choice but to participate in carbon trading.

(If you don’t remember Australia’s failed attempts at a carbon trading scheme here is a good timeline.)

For investors like me, this spells opportunity.

What are carbon credits?

A carbon credit is a tradeable permit that gives its holder the right to emit one metric tonne of carbon dioxide or a chemically equivalent amount of a different greenhouse gas like methane.

Carbon credits are usually rolled out as part of a cap-and-trade system (also known as an emissions trading system, or ETS).

Under such systems, a government allocates or sells a limited number of carbon credits to private companies, effectively creating a “cap” on total emissions. As long as they comply with the cap, those companies are free to buy or sell those credits amongst themselves — or redeem them for emissions rights — as they see fit.

The European Union ETS is by far the largest cap-and-trade system in the world, accounting for more than 90% of the global carbon credit market with a market capitalisation of more than $250 billion.

How do people invest in carbon credits?

Carbon credits are intended as a corporate compliance system. They are not exactly targeted at individual retail investors; buying these credits directly would involve registering an account with the EU ETS, which is a bureaucratic and paperwork-intensive process.

However, if like me you see an investment potential, a better way to invest in carbon credits is indirectly through something like an exchange-traded fund (ETF).

There are a few options out there — I found the KraneShares Global Carbon ETF (KRBN) and iPath Series B Carbon ETN (GRN). Both are traded on US exchanges, so potential investors would need an international brokerage account that allows them to buy such an asset class.

I bought KRBN KraneShares Global Carbon ETF, which is benchmarked to IHS Markit’s Global Carbon Index. The index offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts. Currently, it covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA) and the Regional Greenhouse Gas Initiative (RGGI).

KRBN aims to provide a total return that, before fees and expenses, exceeds that of the IHS Markit Global Carbon Index over a complete market cycle.

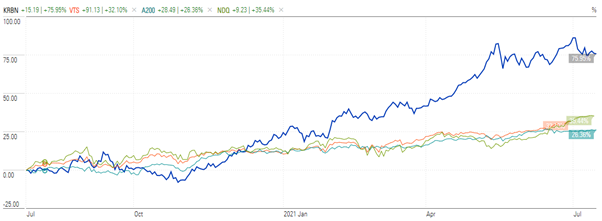

The chart below tracks KRBN (the thick blue line) against other ETFs that track the broader US and Australian markets: the VTS ETF measuring the broad US market; NDQ ETF which tracks the NASDAQ; and A200 ETF, which tracks the Australian ASX 200. The chart covers the twelve months to 16 July 2021.

Sadly I only began investing recently so have only experienced movements at the far right of the chart so far… but here’s hoping.

Have we missed the bull run?

Earlier this month, the 27-member bloc of the European Union vowed to become carbon neutral by 2050 and to reduce its greenhouse gas emissions by at least 55% by 2030 from 1990 levels. As part of its commitment, the EU is expanding its Emissions Trading Scheme for companies within the region, and is planning to introduce a Carbon Border Adjustment Mechanism, which is basically a tax on imports from countries with weaker climate rules.

Canada has also released draft regulations aimed at stimulating domestic carbon credit trading, part of the federal government’s push to curb emissions of climate-warming greenhouse gases. Canadian Prime Minister Justin Trudeau’s Liberal government plans to ramp up its price on carbon to C$170 a tonne by 2030.

Meanwhile, President Biden in the US has made climate action one of his priorities, which may increase interest in carbon credits there.

Australia’s climate policies may not be quite as advanced yet, but there does appear to be an opportunity for this asset class to thrive in other parts of the world, which is what I am banking on with my small investment.

Like cryptocurrencies, I put this in the very high-risk basket. Investors should seek professional advice before buying into carbon credits, which should probably only represent a small portion of their investment portfolios at most.

Of course you can always contact me if you’re interested in discussing this further.

IMPORTANT NOTICE

This blog post contains general information only and has been prepared by Allworths without reference to your objectives, financial situation or needs. Allworths cannot guarantee the accuracy, completeness or timeliness of the information contained here. By making this information available to you, we are not providing professional advice or recommendations. Before acting on any of the information contained here, you should seek professional advice.