A beginner’s guide to investing [Part 2]

By Mark Copsey, Director at Allworths Wealth Management

If you missed Part 1 last month, it’s worth starting there by clicking here.

Last time, I set two pieces of homework: to find a cheap broker and decide what type of investor you are, i.e. defining why you are investing, how long for, and with what amount of risk.

Now, we turn our attention to what strategy you will employ when it comes to making investments, and take a look at active versus passive investing.

Before we start, I need to make it clear that I am not allowed to make any specific recommendations, and the views expressed here are intended as a guide only.

What is active investing?

If you’re not willing to put the time in, don’t do it!

With active investing, you choose your individual investments. For new investors, I do not recommend this strategy. Overpaid fund managers employ teams of people to pick stocks and over the long-term most of them perform poorly anyway.

However, if you insist on being a stock picker, be prepared to put some effort in. The majority (if not all) of the most successful stock pickers in the world treat an investment in shares as buying a stake in the business. This requires you to actually understand the business, including the potential advantages they may possess and the risks they may face. Are you looking for a value stock that will consistently perform over time, pay an increasing dividend and won’t let you down? Or are you looking for the next big growth stock where cash flow may be reinvested back into the business rather than paying out dividends?

If you are really serious about stock picking, then a must read is ‘The Intelligent Investor’ by Benjamin Graham. It’s a big read, but you need to be prepared to put the effort in.

A couple of quick tips to start…

- Avoid the ‘hot tip’ – it’s no better than the certainty of the 3:30 at Caulfield. I’ve been guilty of not doing my research in the past and ended up losing money as a result.

- On ‘meme stocks’ – they’re being shorted (investors betting they will fail) for a reason. The company is likely a dog and should be put down, so avoid them. It may sound romantic saving a company and betting against the machine, but if you don’t get out quickly or join the fad too late you’ll get burnt. Look at AMC’s and Gamestop’s share price in the past month.

If you’re not prepared to put a lot of reading and research time into the individual stocks, I suggest this style of investing is not for you. At the end of this blog post, I’ll share a couple of stories on this.

So what’s a new investor to do?

What are Exchange Traded Funds or ETFs?

It was 3 October 2015 and I had just finished reading ‘A Random Walk Down Wall Street’. My personal portfolio made up of stocks recommended by the research house I subscribed to was down 4.75% for the two years ended 3 October 2015, when the ASX200 was up 4.92% – a gap of nearly 10%.

The following Monday I sold all my stocks bar two, took the hit, and reinvested in a portfolio of ETFs. Now, at the time of writing, I’m beating the ASX by 8%.

My suggested strategy for the new investor is to initially be a passive investor and understand how investments work. The perfect tool for this is the use of ETFs (Exchange Traded Funds). For a more detailed explanation of ETFs see ‘Allworths’ guide to Exchange Traded Funds’.

Some decisions are still required of the new investor in choosing which ETFs to invest in.

For the investor with a small balance, a good starting point may be one of Vanguard’s ready made diversified index portfolios. Depending on the investor type you are, they have a portfolio for you.

| ETF Name | ASX Code | Link |

| Vanguard Diversified Conservative Index ETF | VDCO | Conservative |

| Vanguard Diversified Balanced Index ETF | VDBA | Balanced |

| Vanguard Diversified Growth Index ETF | VDGR | Growth |

| Vanguard Diversified High Growth Index ETF | VDHG | High Growth |

With one trade you get a basket of ETFs (granted, all from Vanguard), which should meet your investor profile.

When we started our wealth management business following the GFC, there were only a handful of ETFs to choose from. I made my first ETF investment in the Vanguard US Total Market Shares Index ETF on 4 September 2013. Sadly at the time I didn’t fully understand (or trust) ETFs and only invested $4,483. I say sadly as now that investment is up 231%. I’ll add I have added substantially to that position since and still done very well.

For the new investor who wants to build their own portfolio of ETFs there is a lot of choice; maybe too much choice to keep the new investor out of trouble. My tips for the new investor are:

- Stick to ETFs that follow an index e.g. ASX200, US Market, European Markets, or Emerging Markets. Mix in some bond fund ETFs to balance your risk profile.

- If you think a particular sector may be in for growth, choose a sector-specific ETF but limit the amount you invest to around 10%. Choose carefully; I thought infrastructure was in for a big kick following Biden being elected in the US and bought into a Global Infrastructure ETF, and it has basically just flatlined. However, I did buy a Global Bank ETF on May 20 after it had collapsed following the March 20 pandemic, and it’s now up 50%. Sometimes you do get lucky.

- Stay clear of the small ETFs with less than $1 billion in Net Assets (all ETFs will have a Fact Sheet that tells you this). There can be liquidity problems in a time of crisis with smaller funds, as I discovered on March 20.

- Check the management costs. BetaShares A200 ETF, which gets you exposure to the Australian Top 200 companies, has a tiny fee of 0.07%. iShares IOZ’s fee is 0.09% and Vanguard’s VAS is 0.10% for similar products. Some ETFs can charge 0.50% upwards. Fees matter and will erode value over time.

- If the ETF has the word ‘Active’ in it, stay clear. They are no better than the poor performing fund managers we spoke about earlier.

- If the ETF has the word ‘Synthetic’ or ‘Gear’ in it, move to the next one. They are too risky for the new investor to understand.

Mix it up a bit

If you have a slightly larger balance, you may want to do as I do and build the core portfolio with ETFs and hold a few individual stocks (my stocks represent less than 10%).

The tale of two stocks

In November 2012 a colleague recommended the next hot tip from his broker. Lynas Corporation, a rare-earth company, which was a “certainty”. After a quick bit of reading, the story sounded OK so I jumped in. Five years later it was down 74%. Eight years later it was still down but by only 45%. At the time of writing it is up 31%. It sounds OK, well not really; had I just sold it back when I sold my other stocks and put the money into the ASX ETF, I’d be up nearly 90% over the same period!

In October 2018 I was reading an article about the demand for lithium and how, with the increase in electric vehicles, the demand was likely to surge. It made sense, Tesla was doing all sorts of cool things in the space and the other car companies were stepping up. So I sat down one afternoon to do my research and zero in on a few Australian lithium miners by reading their annual reports and financials among other things. It was a choice between Galaxy Resources or Orocobre. I chose Galaxy and made a small investment. By October 2020, that well-researched company was down 45%, and a sense of deja vu was setting in. Roll forward to April 2021 and Orocobre (yes, the other stock I looked at) announced a take over bid for Galaxy and whoosh, I was up 126%. Sometimes you can get lucky.

For full disclosure, the other stock I retained back in October 2015 was Santos – which is down 14%.

Conclusion: Stock picking; it’s a mugs game.

About Allworths Wealth Management

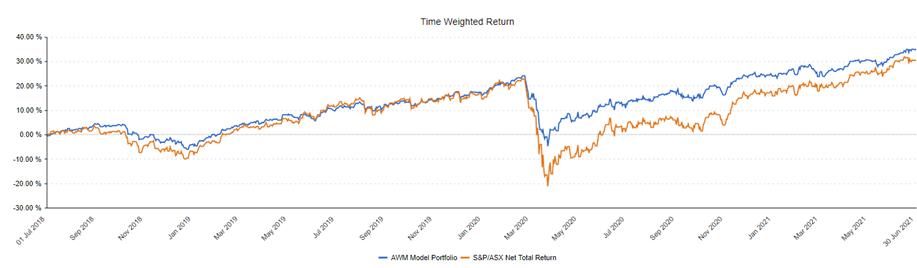

On 1 July 2018, Allworths Wealth Management started a theoretical Balanced portfolio of ETFs, which we use for most of our clients.

For the three years ended 30 June 2021, the portfolio is up 35.08% compared to the ASX200’s 30.59%. If you’d like to discuss your investments, please drop us a line at: growth@allworths.com.au

Coming soon: Part 3 in this series. Next time we’ll look at the most important yet most misunderstood part of investing: investment psychology, which may explain why I held onto the stocks mentioned instead of selling. I am only human after all.

IMPORTANT NOTICE

This blog post contains general information only and has been prepared by Allworths without reference to your objectives, financial situation or needs. Allworths cannot guarantee the accuracy, completeness or timeliness of the information contained here. By making this information available to you, we are not providing professional advice or recommendations. Before acting on any of the information contained here, you should seek professional advice.

Allworths Wealth Management Pty Limited (AFSL 457 155) is the Wealth Management arm of Allworths Chartered Accountants. For further information, please contact us on (02) 9264 6733 or email growth@allworths.com.au.