Using the COVID-19 tax incentives to make asset purchases

Of the several stimulus packages we’ve seen, all intended to boost the economy and offer much-needed support to businesses, much attention has been focused on the cash flow boost and JobKeeper payments. There was another very important package that may have slipped under your radar and it offers significant tax savings if you plan on making business purchases.

In this post, we look at the increased instant asset write-off and accelerated depreciation incentives.

The package works two ways:

- If the purchase price of the asset is $150,000 or less, it is now eligible for instant write-off

- If the purchase price is greater than $150,000, it is eligible for accelerated depreciation

Read on for more information, examples and eligibility…

For asset purchases up to $150,000: instant asset write-off

Businesses with aggregated annual turnover less than $500 million are able to take advantage of the scheme and, with it, any new or used equipment with a purchase price up to $150,000 (ex. GST) that is purchased and installed between 12 March 2020 and 31 December 2020, can be written-off.

Importantly, there is no limit to the number of assets purchased that can be written-off under this scheme. You can purchase multiple assets that total more than $150,000, so long as each individual asset is less than $150,000.

Ultimately, the scheme encourages business investment by allowing these asset purchases to be written-off this financial year; meaning businesses will pay less in tax.

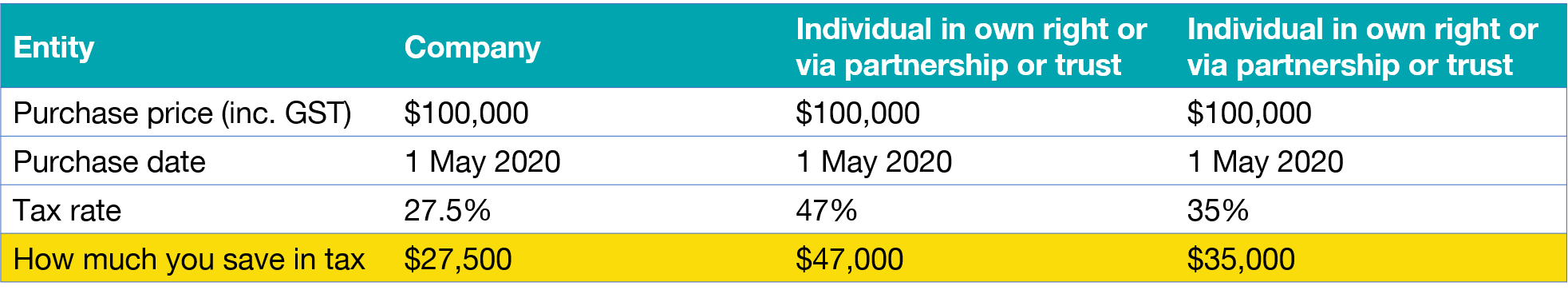

Here’s an example of how much you can save:

Key points:

- Assets can be new or used

- Assets must be acquired prior to 31/12/2020

- Individual assets must be less than $150,000 (ex. GST)

- Multiple assets can total more than $150,000 so long as each individual item is less than $150,000

- Capital works deductions are not eligible

A note on cars and utes

If you intend to purchase a passenger vehicle (one that is designed to carry less than one tonne and fewer than nine passengers) for your business, the instant asset write-off is limited to the business portion of the vehicle only. This means you must assess what proportion of the vehicle’s usage will be for business purposes only, which is best calculated with the help of your accountant.

Additionally, a maximum amount of $57,581 (ex. GST) can be claimed for the instant write-off. If the cost of the vehicle exceeds this amount, the excess cost cannot be claimed under any other depreciation rules.

Here’s an example to display the effect of this limit on a motor vehicle purchase for business purposes:

Bill and Mary own and run a supplies business. On 27 March 2020, the business purchased a luxury car designed to carry passengers for $80,000. They calculate that 80% of the car’s usage will be for business purposes, which means they can claim 80% of the maximum deductible amount, or $46,064. The business cannot claim the excess cost of the car under any other depreciation rules.

Bill and Mary also decided to update their business ute. Their business purchased a ute for $65,000 on 27 April 2020. The ute isn’t designed to carry passengers (and has been configured with trade tools in the tray), so the car cost limit for the instant asset write-off doesn’t apply. As the vehicle is less than $150,000, the business can claim a full deduction of $65,000 as an instant asset write-off.

More info here (via ATO): Instant asset write-off for eligible businesses

Are you interested in knowing more about COVID-19 related incentives? Check out our 2020 Small Business Survival Guide for all the latest updates.

For asset purchases over $150,000: accelerated depreciation

The Backing Business Investment package allows businesses to deduct the cost of depreciating assets at an accelerated rate and is available to businesses with aggregated turnover of less than $500 million for the 2019–20 and 2020–21 financial years.

To be eligible for accelerated depreciation, the asset must be: brand new (not previously held by another entity), purchased after 12 March and installed ready for use by 30 June 2021. Importantly, it can’t also have had the instant asset write-off rule applied. If the asset meets this criteria, 50% of the asset’s cost can be deducted upon installation with normal depreciation rules applying to the remaining value of the asset.

For each new asset, the accelerated depreciation deduction applies in the income year that the asset is first used or installed.

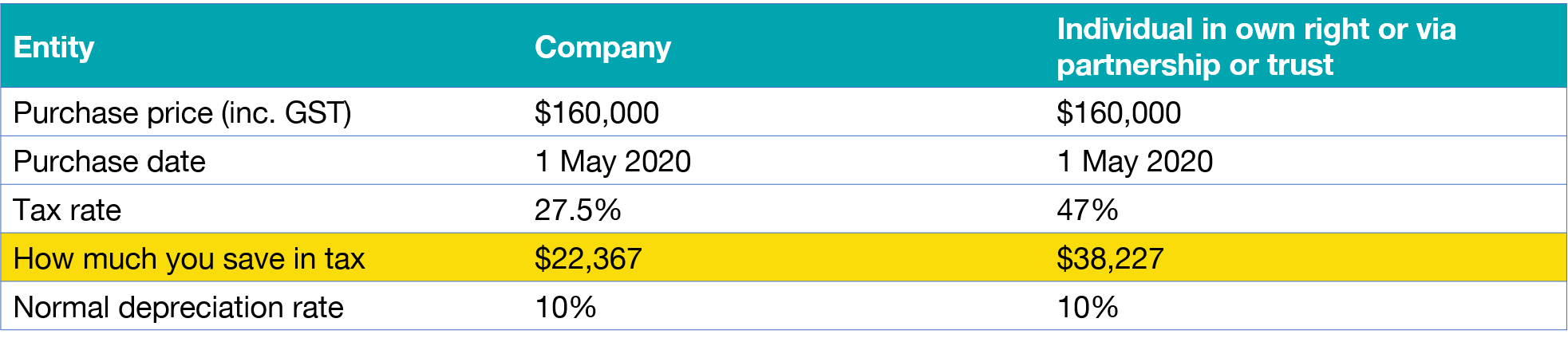

Here’s an example of how much you can save:

Key points:

- Assets must be new

- Assets must be installed or being used prior to 30/06/2021

- Instant asset write-off can’t also be used

Note: assets under $150,000 (purchased or installed in the 2020-21 financial year) can also qualify for accelerated depreciation.

More info here (via ATO): Backing business investment – accelerated depreciation

Last updated: 11 June 2020

Important Notice

The content of this post is general in nature. Any general advice has been prepared by Allworths without reference to your objectives, financial situation or needs.