Protect your income, protect your family

By Mark Copsey, Director of Allworths Wealth Management

What would you do?

Have you ever stopped to think about how you would pay the mortgage, support your family, or pay for your kids’ education if you were unable to work due to sickness or injury? Chances are you are one of the 69% of Australians who haven’t.

You could probably come up with a list of people you know, including relatives, friends and associates, who have been injured or passed away prematurely. As confronting as it may be to think about, if it happened to them, it could happen to you.

A wake up call…

A couple of months ago, I received a call from one of my oldest friends. It was unusual for him to call late on a Thursday night, so I put my plate down and took the call.

“Mate I don’t think I’m going to make it to your 50th next week, sorry”, “Oh that’s a shame, what’s happening?”, “Well tomorrow I’m going into surgery to have a brain tumor removed…”

Fast forward four months and he’s still learning to walk and talk again. Seeing someone go from being the life of the party to this was shattering to say the least.

Putting aside the emotional trauma, he is married, with two young kids, and recently just completed a house renovation with an extended mortgage to go with it.

Fortunately for him and his family, he does have some Income Protection insurance. However, the insurance is only paying 50% of his normal earnings, so there is likely going to be some financial strain on the family.

Watching such a close friend go through this really highlighted to me just how important it is to have protection in the event of unforeseen circumstances like these.

This story is one of a few experiences that have motivated us to do something about the state of underinsurance in Australia. For a limited time, we’re offering $500 cash back for all new policies with premiums of over $2,000 per annum. T&Cs apply: see the link for all the important details.

What is Income Protection insurance?

Income protection insurance pays up to 75% to 85% of your pre-tax income for a specified time if you’re unable to work due to partial or total disability.

Why is it so important?

Income protection insurance can be important if you:

- Are self-employed or a small business owner as you may not have sick or annual leave

- Have family members or dependents that rely on the income you earn

- Have debts, such as a mortgage, where you’ll need to make repayments no matter what

What does it cover?

Broadly, you will be covered if you are temporarily unable to work due to an accidental injury or illness. Some examples include:

- Breaking a leg in a household accident

- Injuries sustained in a workplace accident or a transport accident

- Medical events such as a heart attack or stroke

- Mental health-related illness such as anxiety or depression (depending on PDS)

However, not all policies are the same and generally you get what you pay for.

This is why it is important to go through a professional advisor, as they are able to explain what IS and what is NOT covered. You don’t want to be one of those people who end up saying, “Oh insurance companies NEVER pay…”

How much does it cost?

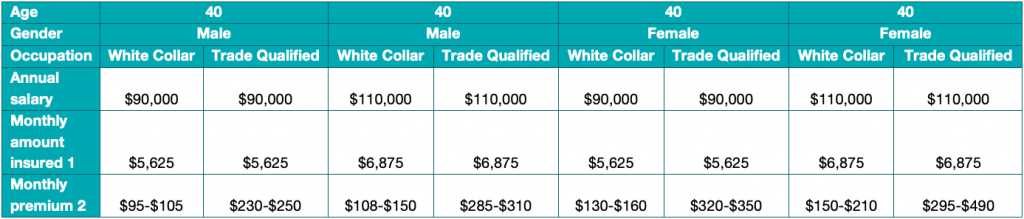

The cost of cover will vary depending on a number of factors, including: age, occupation, amount of cover, waiting period (how long you’re willing to wait until the policy starts paying you), general health and whether you smoke.

The table below provides numerous examples (with indicative premium amounts):

Is it worth going through an advisor?

As mentioned previously, not all policies are the same and this is where it can be useful to enlist the help of an advisor.

An advisor will assess your personal situation and work out an appropriate level of cover based on this. Together, you can discuss your options, including any changes you’d like to ensure the premium fits within your budget, and pick the policy that best meets your needs.

This way, you purchase a policy knowing exactly what you are and aren’t covered for, as well as how to make a claim.

How much does professional advice cost?

You may have seen providers advertise, “At XYZ, you buy direct from your insurer. That means you are not paying commissions…” However, when you go through a financial advisor, at least in our case, we make our money from commissions paid for by the life insurance company – which doesn’t cost you extra. We also don’t charge fees for our time, so there’s nothing more for you to pay beyond the costs of your policy.

There is plenty of questionable or misleading information out there. Another example of this is one online provider who claims to offer 20% off the premium by cutting out the advisor. When you dig deeper you find that YOU have to personally work out how much cover you need.

Poring over multiple PDSs to make sure you’re getting the right amount of cover is not something you should have to do alone! Especially when your advisor isn’t charging you for it…

Thinking about taking out Income Protection insurance for you and your family? Book a free, no-obligation meeting to discuss your needs with Mark.

IMPORTANT NOTICE

This document contains general information only. Allworths cannot guarantee the accuracy, completeness or timeliness of the information contained herein. By making this information available to you, we are not providing professional advice or recommendations. Allworths will not be held liable for any loss or damage arising from reliance on this document, including but not limited to any loss of profit, revenue, reputation, or any consequential losses. Before acting on any of the information contained in this document, you should seek professional advice.