“It won’t happen to me” is not a good strategy

By Mark Copsey, Director of Allworths Wealth Management

As depressing as this may be, think hard for a minute to see if you can come up with a list of people you know; relatives, friends and associates; who have passed away prematurely. My list includes my dad, an aunt, uncle, business partner and a close friend under 40, not to mention a number of clients and business associates.

The trauma of these events can be devastating on the mental wellbeing of affected families. On top of the grief can come financial hardship, which only adds to the stress.

On a personal note, I lost a business partner a few years ago. Fortunately, in a financial sense at least, all the business owners were insured with life insurance. Our agreement is that, upon the death of a partner, the surviving partners need to pay the Estate the value of their share of the business. I can’t deny that without that insurance, we wouldn’t be in business today.

Another time I witnessed the importance of having life insurance was over 10 years ago when we lost a very close friend to cancer. It was a terrible period as she and her husband had a young child. Financially, the impact was softened as she had taken out a life insurance policy, which meant her husband didn’t have the financial strain to deal with on top of the tragedy.

This story is one of a few experiences that have motivated us to do something about the state of underinsurance in Australia. For a limited time, we’re offering $500 cash back for all new policies with premiums of over $2,000 per annum. T&Cs apply: see the link for all the important details.

So what is life insurance and what does it cover?

Life insurance should probably be called death insurance because, generally speaking, it pays a lump sum to a beneficiary upon the death of the policy owner. It’s really that simple.

Not only is it simple, especially with the help of a professional advisor, but it’s generally so affordable that really all Australians should be insured. It’s simply a no-brainer. Unfortunately, the truth is quite the opposite; few are insured and fewer still with the right level of cover. Infact, the median level of Life Cover only meets 61% of basic needs*.

Life insurance also refers to a category of insurance that includes income protection, trauma, total and permanent disability, as well as the life (or death) insurance I just outlined. Learn more about each type of life insurance from one of our other blog posts.

How much does it cost?

The cost of cover will vary depending on a number of factors, including: age, occupation, amount of cover, your general health and whether you smoke.

However, before looking at the examples below, consider this for some perspective. How much do you pay in car insurance each year and what is the value of the car?

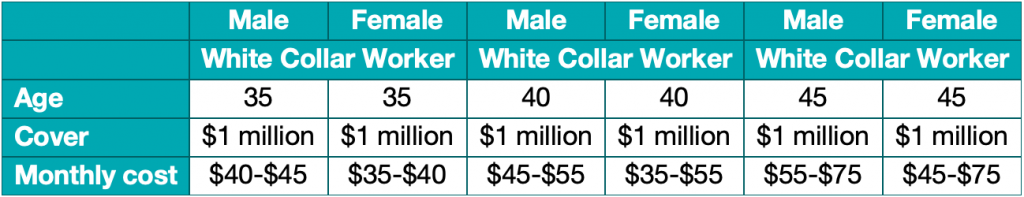

The table below provides examples of life insurance cover with indicative premiums:

Based on a non-smoker, qualified white collar worker, on a stepped premium.

Should I get advice or just take out a policy online?

You’ve all seen the ads on TV or on the Internet that say, “Get instant cover up to $X with just a simple phone call.”

Don’t get me wrong, there is a place for this, but remember that not all policies are the same and you generally get what you pay for.

I decided to road test one of these providers. I filled in a simple online survey and, within a minute of when I pressed send, my phone rang with a lady from the provider. She asked my age and then immediately offered me a $385,000 life cover policy, just like that.

She hadn’t asked anything about my personal circumstances, such as if I had a mortgage, business debt, young children, school fees, etc.

I wanted to test this system further so I replied saying, “Well that’s not nearly enough, I’ll need much more than that.” For this over-the-phone provider, that marked the end of discussion. Her response: “Sorry, I can’t help you.”

At first glance, $385,000 may seem like a lot of cover. But considering most families have a mortgage, credit card debt, and school fees – among many other expenses – when you’re considering this amount as a replacement of a second income over many years, $385,000 won’t go very far.

This is where a professional advisor comes in

An advisor will assess your personal situation and work out an appropriate level of cover based on this. Together, you can discuss your options, including any changes you’d like to ensure the premium fits within your budget, and pick the policy that meets your needs.

This way you purchase a policy knowing exactly what you are and aren’t covered for, as well as how to make a claim.

How much does advice cost?

You may have seen providers advertise, “At XYZ, you buy direct from your insurer. That means you are not paying commissions…” However, when you go through a financial advisor, at least in our case, we make our money from commissions paid for by the life insurance company – which doesn’t cost you extra. We also don’t charge fees for our time, so there’s nothing more for you to pay beyond the costs of your policy.

There is plenty of questionable or misleading information out there. Another example of this is one online provider who claims to offer 20% off the premium by cutting out the advisor. When you dig deeper you find that YOU have to personally work out how much cover you need.

Poring over multiple PDSs to make sure you’re getting the right amount of cover is not something you should have to do alone! Especially when your advisor isn’t charging you for it…

Thinking about taking out Life insurance for you and your family? Book a free, no-obligation meeting to discuss your needs with Mark.

* Rice Warner ‘Underinsurance in Australia 2015’ report

The content of this post is general in nature. Any general advice has been prepared by Allworths Wealth Management Pty Limited AFSL 457 155 without reference to your objectives, financial situation or needs. You should consider the advice in light of these matters and, if applicable, the relevant product disclosure statement before making any decision.