Annus Horribilis: Investing Year in Review

By Mark Copsey, Director at Allworths Wealth Management

As the Queen celebrates her Platinum Jubilee I feel compelled to use part of her famous speech given on the occasion of her 40th anniversary. This past year has turned out to be an ‘Annus Horribilis’ for investing.

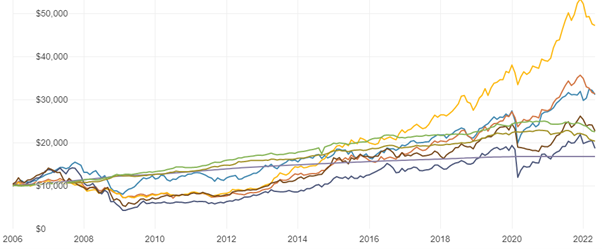

However, as I constantly remind our clients, this was always going to happen and if you cannot stomach the downs you shouldn’t be invested in equities and bonds. As long-term investors, time is our friend and the below chart suggests what we are going through is only a blip in the investment timeline.

I took the chart back to January 2006, to include the GFC for context. Remember when the world as we knew it was going to end? Note: the dollar investment values below are based on $10,000 invested on 1 January 2006.

With the exception of February/March 2020, when Covid gripped the world, we have had a solid 10 or so years growth. Investors should normally expect a correction of some sorts every seven.

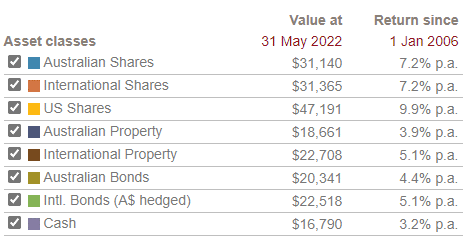

Here’s another interesting fact you may have heard, but it serves as a timely reminder:

How long this current fall will last is anyone’s guess and I’m certainly not stupid enough to make a prediction. But we can always look back at history and according to this article on US bear markets there have been 28 since 1928 and all were followed by bull markets. The average US bear market lasted 289 days. The longest was in 1973/74, which lasted 630 days (less than 2 years). So if you’re a long-term investor (which you should be to be invested in equities) you have time to ride this one out.

So while it is a bitter pill to swallow right now, I suggest to hang in there and stay invested for the long-term. And for those with large cash positions, the next few months could present some exceptional bargains. As Buffet once said, “be fearful when others are greedy, and greedy when others are fearful.”

So what’s going on in the world and why are we in this mess?

Interest rates increasing, war in Ukraine, supply chain issues… Is the world going to end this time around? Hardly!

PMI ratings, which is a measure of a country’s industrial performance, are still positive (with the exception of China and Emerging Markets) but have started to decline. Morningstar suggests alarm bells are not yet ringing but this could indicate deepening problems in 6+ months’ time if things don’t change.

Along with equities, bonds have not performed well on the back of rising interest rates. Interestingly, it is the higher rated bonds (with less risk of default) that have performed worst since their peak in August 2021. Indications are there is minimal risk of default on most highly rated bonds and in my view investors should bear in mind the quality of the assets they hold verses the payoff. In our portfolio construction we favour bond funds holding higher grade bonds and still believe over the long-term the poor performance should correct itself.

With the RBA increasing interest rates to combat inflation this continues to put a strain on both households and businesses. Pressure put on businesses could lead to unemployment and reduced capital spending. Regarding the former this may not be immediate given how tight our labour market is. Anyone trying to employ staff (speaking from personal experience here) in all sectors are finding it extremely difficult and expensive. However, should unemployment spike, this may put pressure on mortgage repayments and – like we saw in 2020 – force the banks to increase their default provisions. As we saw back then, the banks overreacted but it’s something to bear in mind.

Inflation is simply a case of demand outstripping supply. People have a lot of money in their pockets* to spend after the ridiculous handouts governments in the developed world gave away. Add to this the supply chain issues, with China being closed off to the world for a long period of time, and inflation was inevitable. Food inflation in Australia is being affected and looks to continue by the ongoing flooding as well.

However, China is now starting to open up and their quarantine rules are starting to relax, which may be an indication that trade will start to flow again. Inflation and the increased cost of living is starting to dwindle savings (the Australian savings rate fell to 13.6% in the December 21 quarter), which could also sow the seeds of reducing inflation and hence stabilise or reduce interest rates.

*a table of household savings rates shows Australian rates went from 3.7% in 2019 up to 14.4% in 2020. In the UK it was 6.5% to 19.4%, and in the US 7.5% to 16.1% . So people have a lot more money saved up to spend, which is driving up inflation. In Greece they went from negative 11.9% to negative 7.8%!

Another unknown is how long the little mad man will continue pointlessly flattening parts of Ukraine. On a recent flight I watched a movie called Mr. Jones based on the true story of a Welsh journalist who went to Russia and snuck into Ukraine in 1933 to work out how Stalin was funding his army and witness the atrocities the Russians were committing on the Ukrainian people all with the blessing of the US government. Six years later World War 2 broke out. So if Russia is being backed by another superpower where will that leave us I wonder?

As always if you wish to discuss your investments please do not hesitate to contact us.

IMPORTANT NOTICE

This blog post contains general information only and has been prepared by Allworths without reference to your objectives, financial situation or needs. Allworths cannot guarantee the accuracy, completeness or timeliness of the information contained here. By making this information available to you, we are not providing professional advice or recommendations. Before acting on any of the information contained here, you should seek professional advice. Allworths Wealth Management Pty Limited (AFSL 457 155) is the Wealth Management arm of Allworths Chartered Accountants. For further information, please contact us on (02) 9264 6733 or email growth@allworths.com.au.