Australians Living Overseas and Non-Residents Holding Australian Property: A Nasty Sting is Coming…

Under the Australian Government’s latest tax grab (disguised as providing affordable housing to Australian residents), there is a very nasty sting on its way for Australians living overseas holding Australian property and current Australian residents becoming non-residents.

Currently, if a dwelling that was a taxpayer’s main residence stops being their main residence, the taxpayer may choose to continue to treat it as a main residence (meaning it is free from Capital Gains Tax). The maximum period for which the dwelling can be treated as a main residence is 6 years if the dwelling is used for income-producing purposes while the taxpayer is absent.

Each time the dwelling again becomes the taxpayer’s main residence, another maximum period of 6 years starts to run if the dwelling subsequently stops being the taxpayer’s main residence. If the dwelling is not used for income-producing purposes during the taxpayer’s absence, it can be treated as the taxpayer’s main residence indefinitely.

However, a Bill that looks very likely to pass will if enacted apply to remove the main residence CGT exemption where the owner is a foreign resident when the sale contracts are entered into. The changes will apply to:

- All sales occurring after 30 June 2019

- Any sales of residences before this date if purchased after 7:30pm AET time on 9 May 2017

The legislative amendments will entirely remove the entitlement of foreign residents to full or partial CGT main residence exemptions in respect of CGT events occurring to dwellings that would otherwise qualify as their main residence. The other requirements for the CGT exemption (including the “temporary absence” concession, whereby a home can be rented out for up to 6 years without losing the CGT exemption) remain unchanged.

The Bill allows no scope to time apportion the CGT main residence exemption between periods of residence and non-residence during the ownership period.

However, where an individual had become a foreign resident, but re-establishes Australian residency for taxation purposes before the relevant CGT event occurs, the full main residence exemption would apply (subject to the existing rules for a full or partial exemption).

The proposed removal of the CGT main residence exemption for foreign residents for Australian tax purposes is likely to have a significant impact on individuals who relocate overseas for work purposes.

The change once enacted will also affect Australian citizens and permanent residents who are already working overseas and would want to take advantage of rising property values to sell their main residence whilst residing outside Australia as a foreign tax resident.

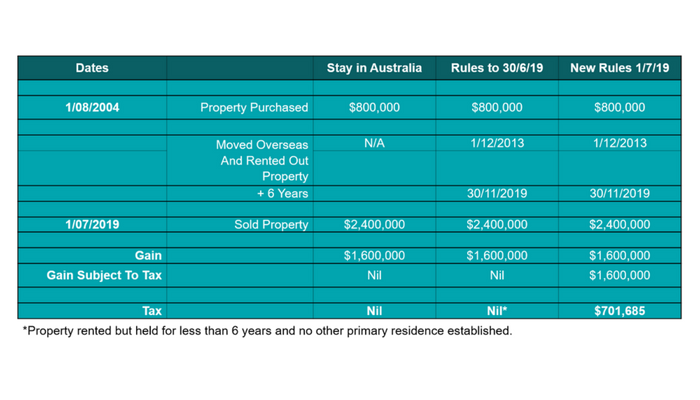

Given Sydney house prices nearly double every ten years, the impact on someone moving overseas could be significant, as the below example demonstrates:

For people holding Australian property, who either live overseas or are contemplating moving overseas permanently, very careful consideration will be required on the timing of any property sales.

We will continue to monitor the situation until the law is passed and will be speaking to clients who we know are affected.

If you believe these rules will apply to you, please do not hesitate to contact us and ask for Mark Copsey, Partner. And please share this post with any affected friends or colleagues.