“How can I have a tax bill if there’s no money in the bank?!” Understanding the importance of cash flow

By David Downie, Partner at Allworths

Anyone in small business has probably felt the sting of a cash flow shortfall at tax time. That is, you have done well and produced a profit but either:

- Not collected monies owed to you (“receivables”), or

- Paid for things you shouldn’t have

Bottom line: you owe the ATO money that you don’t have! It’s not a good feeling.

We don’t want to overcomplicate things – the timing of collections and outlays is all this really comes down to. Staying on top of your receivables and being judicious with your spending are the main ways to prevent this from ever happening to you. There are others, which we’ll also consider in this post. This all requires a great deal of strategic thinking and looking ahead on a consistent basis, but it just might save your business!

When people say, “cash is king,” this is what they’re talking about…

Why does this happen so much?

Business owners are time poor and these issues (even if they sound simple) take careful thought and time to address. It’s the sort of thing that falls to the wayside when prioritising sales or day-to-day firefighting. It’s easy to be a little reactive when it comes to the finances.

Many of us have a gut feel as to how things are going and operate on that basis in the early days. This is risky when it comes to finances! One invoice that goes uncollected or one extravagant purchase that should have been delayed could bring down the whole house of cards.

The other reason is that your bookkeeper or accountant is also fairly time poor and mostly focused on ensuring you don’t break the law (e.g. record-keeping, tax, super, etc.). That is pretty much a full-time job when you have hundreds of clients, which is why most firms haven’t made the leap from reactive compliance work to proactive advisory work!

Sure, you’re not breaking the law, but who’s making sure you’re not breaking your business?!

How do cash flow shortfalls happen?

Simple. Timing.

In a recent talk we gave on this topic, we used a hypothetical example of a small business. We introduced three financial statements with made up data: Profit and Loss, Balance Sheet and Cash Flow. In your business, your bookkeeper or accountant can churn out the first two easily enough using Xero or whichever cloud accounting platform you use. However, they’re probably not providing you with the third one (kudos to them if they are)!

This is common and symptomatic of a reactive mindset, like we mentioned above.

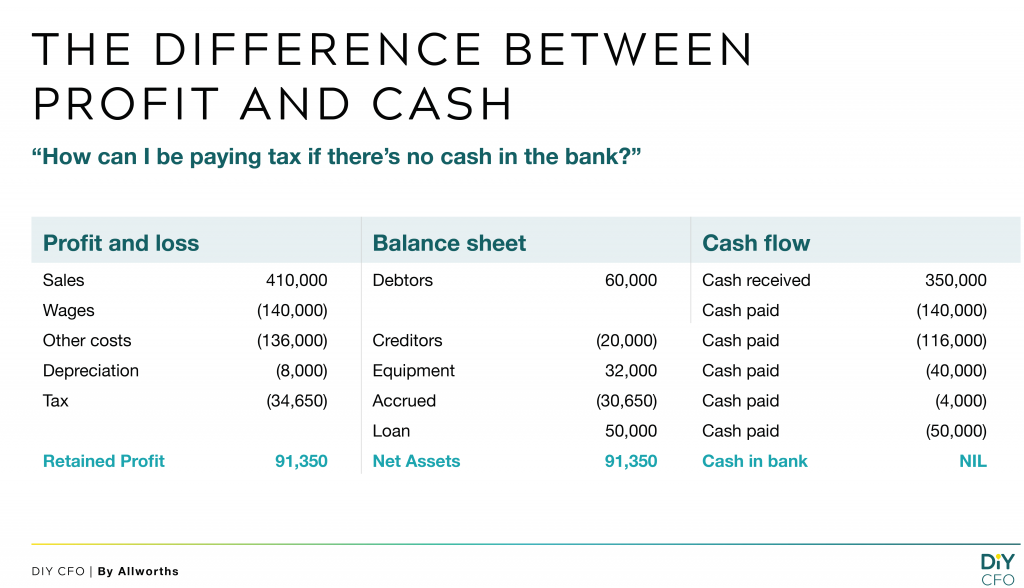

Here is the example we used:

This hypothetical business has had a good month and produced sales of $410,000 with a $91,350 taxable profit. This will be subject to company tax, regardless of how much cash is in the bank.

In figuring out why we’re seeing ‘NIL’ cash in bank, you need to read the table line-by-line across the three statements:

- From the sales made, only $350K was received in cash (meaning $60K is owed to the business by customers and goes onto the balance sheet as ‘Debtors’)

- $140K was paid in wages

- Of the ‘other costs’, $116K was paid in cash (meaning $20K is owed by the business, e.g. on a credit card, and goes onto the balance sheet as ‘Creditors’)

- There was an equipment purchase of $40K in a lump sum cash payment

- There was $4K in tax paid

- A loan was made (e.g. to a director) of $50K in cash

This all resulted in ‘NIL’ cash in bank.

None of these 6 events are particularly shocking or dangerous on their own, but the fact that they all happened at the same time has put this business in jeopardy!

No one should feel dumb or incompetent for having this happen in their business – sometimes it’s just genuinely hard to prevent. We all know your real P&L and Balance Sheet statements are more complicated than our examples, making them hard to really digest and understand. Then there’s the additional problem of (probably) not having access to a cash flow statement or forecast at all!

So yes, don’t feel bad if this has happened to you!

Fixing cash flow shortfalls

Short-term fixes including financing the shortfall, but you really need to use this sparingly and urgently investigate the underlying reasons.

To prevent the shortfall from happening, you need to be able to see it coming. There was a hint earlier: you don’t just need a cash flow statement; you need a cash flow forecast.

At Allworths, we run a weekly 3-month cash flow forecast on our own business so at any given point we can see potential issues arising before they hit. This way, we are able to make data-driven decisions regarding the timing of business decisions we are looking at making (along with chasing our receivables if need be, which we have automated through Xero).

The only way to fix these issues is to: 1) see them coming, and 2) act before it’s too late. This is actually pretty interesting because this is where accounting becomes a creative exercise and a truly proactive one. That is, solving client problems before they’ve happened.

Relating back to our earlier example, let’s look at what could be done about each of the 6 events. Remember that you don’t need to do everything below to fix this shortfall (even the right one measure will fix it in this case), but you need to think creatively about your options, which include but aren’t limited to:

- On sales: ensure all outstanding invoices are followed up and cash is received before the end of the reporting period (you could even automate this process to an extent like we did through Xero)

- On wages: are all personnel necessary and working to capacity or could any functions be “automated”, outsourced or combined into the one role in the near future? (remember that this one may be a false economy and not the best place to start!)

- On debts: it’s not the worst thing to have a sustainable amount of debt in the business; in this case it has actually helped the shortfall situation by requiring less cash to be spent

- On purchases: was the $40K lump sum equipment purchase the best way to go in this reporting period? Could different payment terms have been negotiated with the supplier or could the equipment have been financed?

- On tax: generally unavoidable, but of course you could explore whether the optimal tax outcome was achieved by looking at deductions and tax incentives.

- On loans: was this loan absolutely necessary? Could it have been given in smaller amounts over time? Was it an extravagance on the part of the director(s)?

Being stricter with your debtors and seeking more generous payment terms from your suppliers are generally great starting points. You don’t want to change too many variables at once.

But if you have done some experimentation and still produced shortfall after shortfall, you need to consider more fundamental issues with your business model.

Perhaps you’re not charging enough, or your own payment terms should change (e.g. from monthly billing to quarterly). Big decisions like this have implications on your clients, which need to be considered. However, addressing an unsustainable business model will quickly become crucial to saving the business.

You’re not alone

Cash flow planning requires a concerted effort and is entirely focused on the future. Putting measures in place to prevent cash flow shortfalls is a surprisingly creative exercise that requires thought given to all aspects of your business strategy, goals, systems, policies and procedures. This is something the internal management team needs to lead, possibly with the expert support of an advisory (not just compliance) focused firm.

While many bookkeepers and accountants are reactive and compliance focused, we are making the transition into proactive advice for our SME and startup clients. We are introducing a range of services to help you address these sorts of issues on a consistent basis. We’re open to having a no-obligation chat if you would like to explore if and how we may be able to assist your business with all this.

In any case, we hope you found this post useful and please share it with your fellow business owners. This is an issue facing us all and we should help each other address it.

Further Resources

This post came out of a recent seminar talk we gave on adopting sound financial business practices and thinking like a ‘Chief Financial Officer’. Here’s a link to the seminar video, fast-forwarded to the discussion on cash flows.